Canada Outlook – Sticky core inflation challenges Bank of Canada

Key points

- 2023 growth was firmer than forecast, but GDP has stagnated since Q2 and is on the brink of recession. The lagged impact of policy tightening is a key risk

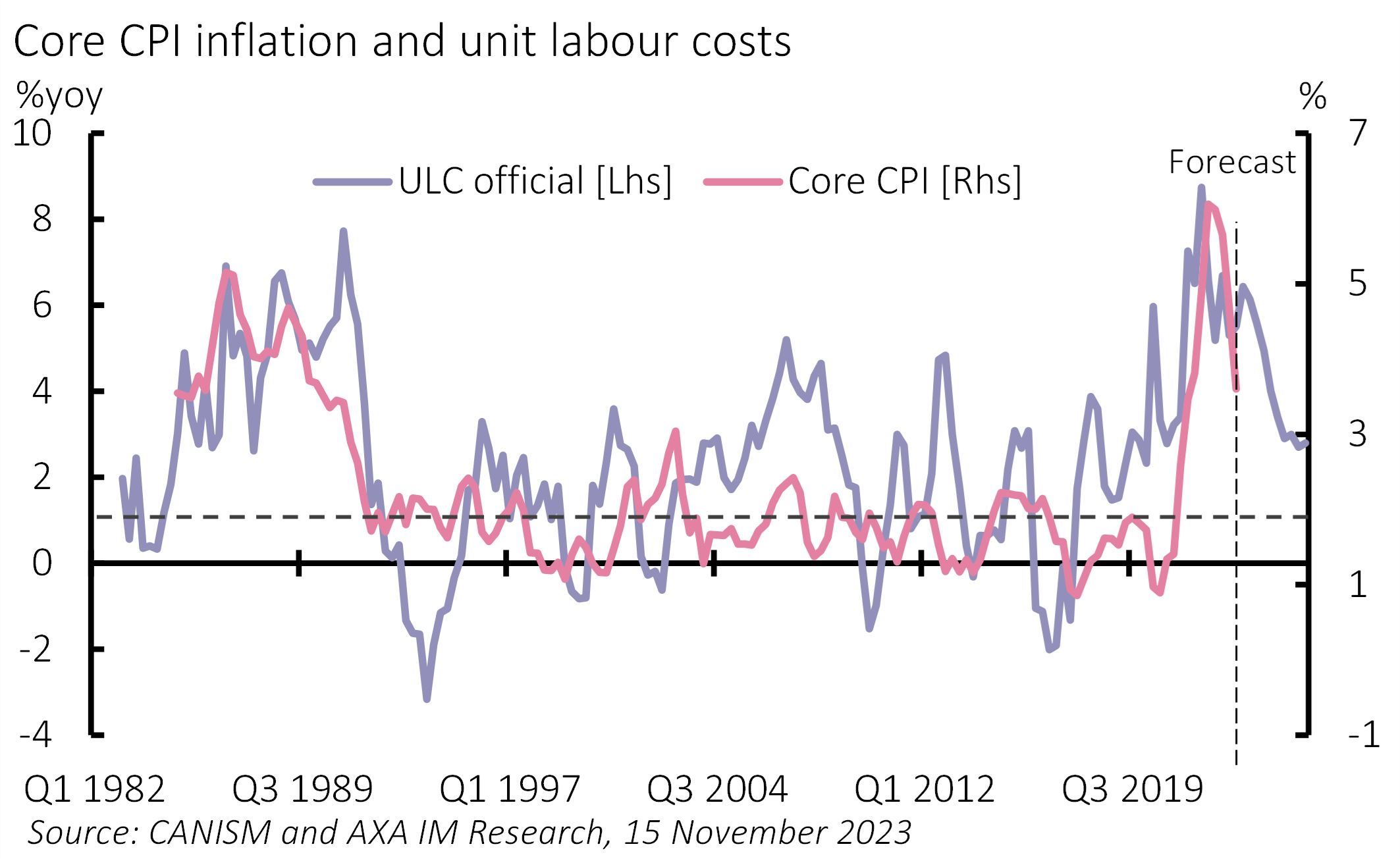

- Inflation fell broadly in line with expectations, but core measures remain elevated. Elevated unit labour costs will make reaching the 2% target a challenge

- Rates have likely peaked at 5.00%; we see a delayed easing cycle from July 2024 to 3.50% by July 2025

On the cusp of recession

Canada’s economy fared better than we feared a year ago, helped by a strong start and resilient neighbour. But growth has stagnated since Q2 and recession is a threat as households weather the lagged impact of Bank of Canada (BoC) tightening. Moreover, with strong population growth (2.9% to mid-year), Canada’s per capita GDP growth was the worst in the G7.

The household sector is a key concern. Like UK households, Canadians are set to bear the brunt of monetary policy tightening. By end-2023 only around 40% of households will have seen mortgage resets reflecting higher rates. That will rise above 60% by end-2024 and 80% by end-2025. We forecast a softening in jobs growth and slower wage gains to soften real income growth even as inflation falls. And Canadian households are highly indebted compared to G7 peers, providing less scope for rising borrowing. That said, unlike in the US, households still have elevated savings which should cushion spending, but we expect continued weakness in consumption and modest contraction in coming quarters.

Beyond household weakness, recent corporate profit declines, higher rates and a weak outlook should see business investment retracement over coming quarters, albeit that Canada has been a beneficiary of US investment incentives supporting foreign direct investment. Moreover, an expected slowing in external growth is likely to weaken exports – even as a terms of trade boost supported exports this year. Net trade looks set to be neutral in 2024 and 2025, from a strong boost in 2023. We forecast GDP growth of 1.1% this year, followed by 0.5% next year and 1.7% in 2025. Weaker US or China growth would push the economy into recession, as could a bigger lagged impact from the BoC’s tightening.

Inflation has fallen from 8.1% in June 2022 to 3.1% in October. Inflation should average 4.0% in 2023, close to the 4.2% envisaged a year ago. Most disinflation has reflected energy base effects and core measures remain elevated leading the BoC to warn of core inflation stickiness. We forecast inflation to fall further to average 3.2% in 2024 and 2.6% in 2025.

Exhibit 1: Weak productivity adds to BoC inflation challenge

Canada faces idiosyncratic and interrelated challenges in achieving core disinflation. It is a high-migration economy; it has high housing costs and relatedly elevated household debt; and it has suffered from weak productivity growth since the pandemic – unusual given its high-skilled migration policy. A sharp increase in public sector employment and protracted business investment weakness are proximate causes of this, but the International Monetary Fund has raised concerns about resource misallocation, highlighting similarities with other economies experiencing housing booms. Weak productivity looks set to keep unit labour costs elevated and challenge core inflation returning to 2% even in 2025 (Exhibit 1).

The BoC is focused on getting inflation to target and is very concerned about core inflation. Yet, the economy appears on the brink of recession, threatening a more meaningful adjustment in housing with financial stability repercussions. We expect the BoC to leave policy at 5.00%, allowing real rates to increase over the next few quarters. Yet concerns about inflation stickiness suggest a slower easing in policy next year, even in the face of weak growth. We forecast the BoC to cut rates by 125bps over 12 months from July 2024, taking the key rate to 4.25% by end-2024 and 3.5% by July 2025. This is slightly later than markets forecast – and what pure policy rules imply. These challenges highlight why the BoC is keen for fiscal and monetary policy to be aligned, something Finance Minister Chrystia Freeland’s recent Budget broadly delivered.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.