COVID-19: Has your workplace changed forever?

Key points

- The COVID-19 crisis threatens long-lasting changes to the way we work. It is affecting employees and employers everywhere.

- The impact so far has been considerable but varies sharply according to industry and country. The latest data show that half the global workforce is at risk of losing their livelihoods.

- There are major concerns regarding the ongoing viability of companies, large and small. Some are in short-term survival mode – others are accelerating strategies to digitalise and automate.

- We are seeing encouraging examples of companies adopting stronger human capital management practices compared to previous economic shocks. These include better management of employees’ well-being, as well as avoidance of unnecessarily harsh redundancy practices – which can lead to labour market harm.

- In the long term, we may see a deep disruption in the way society thinks about “work” – who does it, where, and how. Working-from-home policies, gig workers’ rights, and supply chains are some of the crucial human capital management themes for our post COVID-19 world.

Workers on the front line

The COVID-19 crisis is threatening to change the world of work forever. Industries such as hospitality, tourism and aviation may re-emerge permanently altered. In other sectors, such as high street retail, the pandemic is accelerating the demise of business models which were already under considerable stress. Elsewhere, in areas like information technology or financial services, there is a wholesale rethink as to the idea of work itself – where it is carried out, who does it and how.

For the workplace, the legacy of this pandemic could be the biggest global shift in attitudes to labour since the late 18th century when the industrial revolution made it the norm to work and live in close proximity with others in urban settings.

Even in the immediate short-term, the impact of this crisis is without equal. The International Labour Organization (ILO) assessed that virus containment measures have put nearly 1.6 billion workers at risk of losing their livelihoods1. This is about 50% of the global workforce. Developing and developed countries alike will be left with deep social and economic scars.

More than 400 million companies worldwide are facing severe disruption which threatens their ongoing viability2 – it is a moment of extraordinary turmoil, and employees can often be first to feel the effects. In the US, 15% of the workforce (36.5 million) sought unemployment benefits between mid-March and early-May. This could potentially bring total unemployment up to the 25% level3. In the EU, the unemployment rate is forecast to peak at 9% in 2020 (up from 6.7% in 2019)4.

We fear that COVID-19 will make a severe dent in ambitions to achieve the 2030 Agenda for Sustainable Development as encapsulated in the United Nations Sustainable Development Goals (SDGs). Below we have displayed the SDGs that we believe are most under threat in this environment:

Scrutiny of companies’ claims

The crisis has proven to be a very public test case for company approaches to sustainability and corporate responsibility. We are increasingly able to assess whether the social policies highlighted in company reports and websites have any practical merit or were just a public relations exercise.

At AXA Investment Managers (AXA IM), we believe that company employees are a critical and material driver of investor value creation5. As a result, we closely assess how companies look after their staff by providing fair and high-quality employment.

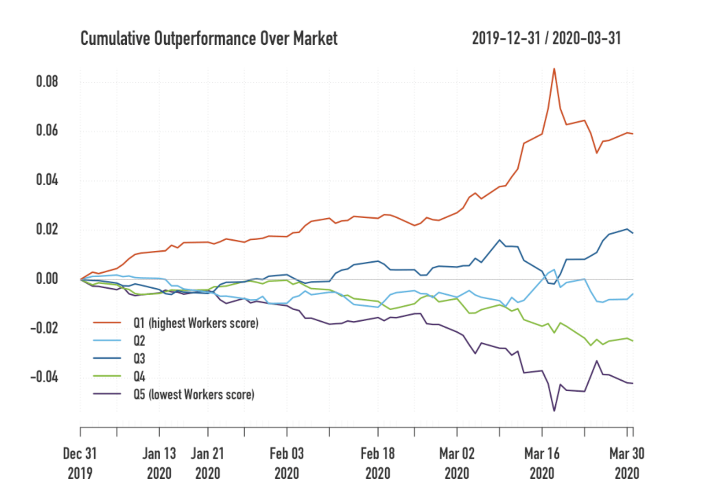

We consider it important that companies take every reasonable measure to support their workers during this exceptional situation. Such an approach can have positive and profound short- and long-term financial consequences. Research by Just Capital has shown6 that among large US-based companies, those that have delivered more support to workers have outperformed their peers during the crisis.

Benefits of a good human capital management strategy in these tense times should also be seen during the recovery period as well. Companies that have deployed the most proactive and flexible responses towards their employees (e.g. working from home agreements, adequate health measures to protect workers on site, paid sick leave etc.) will have them ready to work once the economy picks up again. A much stronger sense of worker engagement is a potential added bonus, as is the brand impact of positive coverage in the press and on social media. How a company treated its staff during the crisis is a good signal of how it values employees in normal times, and is likely to increase the attractivity profile for future applicants.

The COVID-19 crisis will give more prominence to the study of social factors in the investment industry. We identify below some key topics emerging as lasting trends for the workplace. These will serve as a basis for our research and engagement discussions with companies during and after this pandemic:

Home working – norm, not the exception

This crisis will spell the end of working from home being seen by some employers as a “duvet day”. This is a good thing and long overdue.

Employers would be wise to maintain freedoms for employees on remote working. Providing employees with the option to work from home provides a better work-life balance especially for those with childcare responsibilities or long commutes. For some, there is evidence of higher employee satisfaction with no real detriment to productivity7 – a major reason why companies have refused homeworking before.

Before the outbreak, remote working remained marginally utilised by employers and employees, mainly due to a lack of trust in employees and inadequate IT systems. As an example, only 7% of US workers were eligible for flexible working options8 in 2019. The crisis has suddenly reshuffled the cards – home working has become crucial to the continuation of many businesses and has expanded widely across sectors.

We expect that some companies may shape remote working policies with a focus solely on advantages for the business itself, such as imposing days of remote working on all employees. This isn’t ideal for every worker and will depend on individual circumstance. A study in New Zealand9 helped debunk the myth of remote working as a simple “privilege” and collected a significant variety of feedback from home-based teleworkers depending on their gender and seniority, their home circumstances and nature of their job.

Our scrutiny will be more important in countries where there is no specific legislation to protect workers from home-working pitfalls (e.g. French law “Right to disconnect”) and where workers’ rights are less protected due to lack of support from trade unions and other organizations.

Supply-chain reshaped

The crisis has exposed limitations in global supply chains – and highlighted the vast cross-border interdependencies of our industries. The start of the lockdown in China had a domino effect on a vast number of companies that were relying on goods and components. There was sometimes a lack of oversight on production of strategic products, and a likely response will be the onshoring of parts of the supply chain.

This factor has also affected the government response to the pandemic. Pharmaceutical and healthcare equipment companies have struggled at times to secure ventilators, personal protective equipment and potential treatments due to a lack of domestic supply and production capabilities. We expect supply chains for many products may now be decided by national security and critical infrastructure considerations rather than by cost and quality.

This will raise two issues, in our view. First, we want to address how companies will evaluate social impacts at the supplier level offshore and the actions they can implement to assure a smooth transition. Second, in the case of onshoring part of the industrial process, a potential increase in labour costs may encourage companies to seek out savings that could exacerbate inequalities or chip away at employee conditions at local sites.

For companies that stick to a sizeable net of dispersed suppliers, we expect commitments toward transparency that reach beyond the direct suppliers and into the second and third tiers of indirect suppliers. We also expect them to keep undertaking robust sustainability risks assessment, including regular independent audits.

Gig workers on the front line

The crisis has exacerbated the main issues faced by gig workers, such as limited access to employee benefits like health/unemployment insurance and sick leave. We have broadly seen two different categories of workers emerge: those left with little or no work because of a sharp fall in demand (e.g. baby sitters, house cleaners); and those who kept working due to demand for essential goods and services despite facing infection risks (e.g. delivery drivers and taxi drivers). While the common government request worldwide was for people to stay at home, most gig workers couldn’t afford to self-quarantine and stop working.

This category of workers is set to expand in the long term due to established structural changes driven by technology, and in the short term as a route to secure income for those made out-of-work by the pandemic. It is the right time to engage with companies that use gig workers as the basis of their business model to consider how they can better strike a balance between fair treatment and business viability.

This pandemic has sharpened the focus on companies where treatment of gig workers was already a significant reputational issue. For some this has endangered their “social license to operate” – the implied acceptance of the public that allows a company to go about its business – as well as risking a knee-jerk regulatory/government response. Our engagement discussions with such companies will include encouraging the right to paid leave/paid sick leave for all staff in the kind of exceptional situation we have seen with COVID-19. Another major question is the end-status of workers: whether they are independent contractors or direct employees of a staffing company. The issue is topical in California, where a bill could force ride-app companies such as Uber or Lyft to give their gig workers employee status and its related benefits.

- ILO Monitor: Covid-19 and the world of work. Third Edition. https://www.ilo.org/wcmsp5/groups/public/---dgreports/---dcomm/documents/briefingnote/wcms_743146.pdf

- ILO Monitor: Covid-19 and the world of work. Third Edition. https://www.ilo.org/wcmsp5/groups/public/---dgreports/---dcomm/documents/briefingnote/wcms_743146.pdf

- Coronavirus: Fed chairman Powell warns downturn ‘may last until late 2021’, BBC News, 18th May 2020 ‘

- EU forecasts, 6 May 2020

- AXA IM, Human Matters, 2018

- Just Capital, 2020

- Does working from home work? Evidence from a Chinese experiment, 2013

- World Economic Forum ,2020

- Disrupted work: home-based teleworking in the aftermath of a natural disaster, 2015

Not for Retail distribution

This document is intended exclusively for Professional, Institutional, Qualified or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document. Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.