ESG and financial returns: The academic perspective

Key points

- An increasing amount of academic research is showing that the incorporation of environmental, social and governance (ESG) factors can potentially lead to better performance for both companies and their investors.

- This is fundamentally dispelling the long-held stereotypical view that investing responsibly means sacrificing investment returns

- In this document, we highlight a variety of academic research which demonstrates the positive link between ESG and financial performance

- These studies support AXA Investment Managers’ ambition and commitment to integrating ESG factors into investment analysis, engaging investee companies and developing impact investing – as we believe it is in our clients’ long-term best interests to do so.

ESG delivers value to investors. This is our view and the key conclusion of this paper. This is supported by the rising amount of academic studies into responsible investing.

Below, the first section focuses on studies linking ESG factors as a whole - and looks at the relationships between corporate and investment performance – what could be dubbed “ESG alpha” – for different asset classes. Some studies consider ESG factors from both a risk i.e. exclusions point of view, as well as from a best-in-class/positive ESG momentum perspective.

The second part examines academic studies focusing on specific ESG issues, and their relationship with financial performance.

While we have made efforts to analyse studies which are robust and peer-reviewed, we cannot deny that there may be potential biases in other studies that undermine the strength of the findings. During our research, an issue we often came across was the misunderstanding between correlation and causality. The positive relationship between ESG and financial returns does not mean that the latter is caused by ESG factors.

Financial performance is driven by many other factors – not just ESG. On this issue, we tried to select studies with a sufficient level of control, to ensure relevant results. Other biases that exist includes selective use of data by researchers.

ESG integration and financial performance

Below, we highlight two publications which are meta-studies:

Friede, Busch & Bassen (2015)1 looked at more than 2,200 empirical studies on the link between ESG and corporate financial performance. The results show that approximately 90% of studies analysed found there was a relationship between ESG and financial performance – and a large majority of these showed this was a positive relationship.

University of Oxford (2015)2 looked at more than 200 academic studies, industry reports, newspaper articles and books. Among these sources, 88% indicated that companies with strong sustainability practices demonstrate better operational performance, which ultimately translates into cash flows. In addition, 80% showed that strong sustainability practices have a positive influence on investment performance.

Equities

In the equity asset class, some of the most interesting academic studies capture the relationship from a risk and return perspective.

Khan, Serafeim and Yoon from the Harvard Business School (2015)3 used ESG factors identified as financially material, on an industry-by-industry basis, by the Sustainability Accounting Standard Board (SASB). It found that firms scoring well on material ESG issues deliver up to 6% annualised alpha performance. In contrast, firms with good ratings on immaterial sustainability issues i.e. the “noise” of sustainability reporting, do not significantly outperform firms with poor ratings on the same issues.

Similarly, Sherwood and Pollard (2018)4 used ESG and non-ESG integrated emerging market indices. The paper looked at several return indicators - historical returns, beta, Sharpe ratio, Sortino ratio, conditional value at risk and Omega ratio. The results indicate significant outperformance of emerging market equities due to ESG integration.

When it comes to portfolio construction, Kempf and Osthoff (2007)5 adopted a simple strategy - buy stocks with high ESG ratings and sell shares with a low score. The paper indicates that it leads to high abnormal returns of up to 8.7% per year. Of note, the abnormal returns remain significant even after considering reasonable transaction costs.

Fixed Income

Ge and Liu (2015)6 studied firms’ Corporate Social Responsibility (CSR) performance and the relationship with the cost of new bond issuance. After controlling for credit ratings, it shows that better CSR performance is associated with lower yield spreads – even if some of the effect is absorbed by credit ratings. The results also indicate that firms with strong CSR performance can issue bonds at a lower cost.

The idea that good ESG performance leads to a decrease in bond yields is also supported by Oikonomou et al. (2014)7. The empirical analysis is based on an extensive longitudinal dataset. It suggests that overall, good ESG performance is rewarded and corporate social transgressions are penalised through lower and higher corporate bond yield spreads respectively.

Specifically, within the green bond market, researchers have examined the consequences of green bond issuance on issuers’ financial and investment performance. Flammer (2018)8 indicates that those issuing green bonds enjoy an improvement in operating performance and wider environmental practices.

Another study by Flammer (2019)9 looked at companies’ financial and environmental performance following the issuance of green bonds. It noted that the equity of the issuer saw an abnormal positive increase on the day of the green bond issuance being announced. This suggests that equity markets are responding to the green bond market. Notably, these results are only significant for green bonds that are certified by independent third parties (usually ESG rating agencies).

Engagement

At AXA IM, we believe that engaging with our investee companies is a vital component of our approach to responsible investment.10 We seek to identify a specific area where we use engagement as a method to drive change within investee companies. The aim of our engagement activity is to protect investor value and deliver increased performance over the long run.

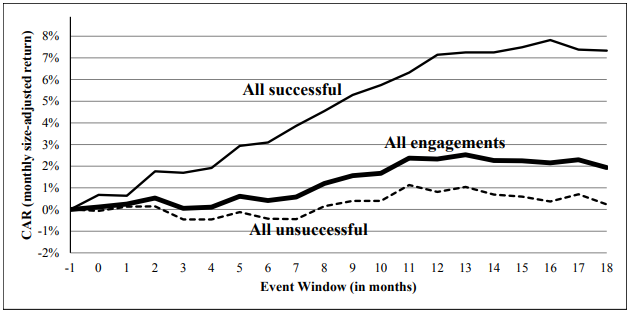

A pioneering academic piece on the value of ESG engagement, in our view, was delivered by Dimson et al. (2012)11. This study of investor engagement with US companies over a 10-year period found successful engagement was followed by positive abnormal returns, at a +4.4% average. On the other hand, unsuccessful engagement has no impact on returns. In 201712, a follow-up study also looked at more than 1,800 collaborative engagements coordinated by the United Nations’ Principles for Responsible Investment. It found evidence that successful engagement is linked to increased return.

Figure 1: Cumulative abnormal returns around initial engagements

Source: Dimson et al. (2012)

Gond (2017)13 adopts a more qualitative approach. He highlights the benefits of engagement, in terms of sharing information and building knowledge, as well as in terms of shifting the internal political dynamics within companies - including escalating issues to board level.

From a risk perspective, Hoepner et al. (2018)14 looked at how engagement on ESG issues can benefit shareholders by reducing firms’ downside risk. Engagement appears most effective in lowering downside risk when addressing governance or strategy topics and when changes in firms’ social policies are coupled with governance improvements. The study finds corroborating evidence in that successful engagement reduces a company’s exposure to a downside-risk factor.

Exclusions

Exclusion of companies from sectors such as tobacco and controversial weapons is one of the longest-running approaches to responsible investment. Heinkel et al. (2001)15 showed that the cost of capital of companies excluded by green investors increased compared to the most environmentally sound corporations.

This result has been empirically supported by several papers, notably by Chava (2014)16. His paper finds that investors demand higher expected returns on stocks excluded by environmental screens compared to firms without environmental concerns. Lenders also charge a higher interest rate on bank loans issued to firms with these environmental worries.

However, the impact of ESG exclusions on portfolio performance can be seen differently. For instance, Hvidkjaer (2017)17 identified several studies with different conclusions around the performance of “sin stocks”. He finds that sectors like tobacco can have attractive characteristics, including their defensive characteristics in difficult market conditions.

Specific ESG issues and financial performance

Environment

Konar and Cohen (2001)18 highlighted the positive impact on the financial valuation of US companies through the creation of intangible asset value. The study relates the market value of firms in the S&P 500 to objective measures of their environmental performance. After controlling for variables traditionally thought to explain firm-level financial performance, it found that bad environmental performance is negatively correlated with the intangible asset value of firms.

Bauer and Hann (2014)19 used information on the environmental profile of 582 US companies between 1995 and 2006. With numerous controls applied to companies, bond characteristics, alternative model specifications and industry membership, the paper found that:

- Environmental concerns are associated with a higher cost of debt financing and lower credit ratings

- Proactive environmental practices are associated with a lower cost of debt.

Social

Academic research dedicated to social issues and financial returns rely on measurable factors, such as gender diversity and employee satisfaction. A widely quoted study, Edmans (2011)20, analysed the relationship between employee satisfaction and long-run stock returns. A value-weighted portfolio of the “100 Best Companies to Work for in America’’ earned an annual four-factor alpha of 3.5% from 1984 to 2009, and 2.1% above industry benchmarks.

These findings suggest three main implications. First, consistent with human capital-centred theories of the firm, employee satisfaction is positively correlated with shareholder returns and need not represent managerial slack. Second, the stock market does not fully value intangibles, even when independently verified by a highly public survey on large firms. Third, certain socially responsible investing (SRI) screens may improve investment returns.

Along with Li and Zhang, Edmans (2017)21 extended the work on employee satisfaction and stock returns to 14 countries. The study found that employee satisfaction, measured to lists of the “Best companies to work for”, is associated with superior long-run returns, current valuation ratios, future profitability, and earnings surprises. The results are valid in flexible labour markets, such as the US and UK, but not rigid labour markets, such as Germany.

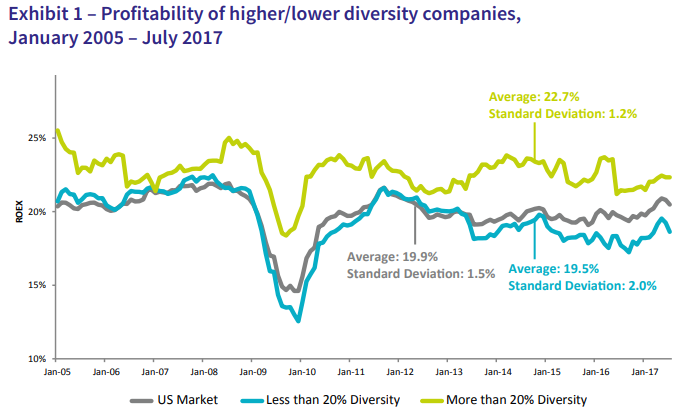

With regards to gender diversity, AXA IM Rosenberg (2018)22 found that firms with higher diversity levels1 are potentially associated with higher current profitability as well as higher future profitability. Among the most profitable firms, those with greater board diversity also showed a better ability to withstand competitive forces compared to their less diverse peers. When isolating the highest profitability companies, it finds that there is a possible ‘profitability moat’ that is attributable to higher diversity.

Source: AXA IM Rosenberg. Higher ROEX does not necessarily equate to outperformance.

“US Market” refers to the 1000 largest US companies over the period January 2005 – July 2017.

Governance

The key pieces we found around the governance pillar are related to shareholders rights and power. Gompers (2003)23 used an investment strategy that bought firms with the strongest shareholders rights and sold firms with the weakest rights. This strategy earned abnormal returns of 8.5% per year during the sample period. The study found that firms with stronger shareholder rights had higher firm value, higher profits, higher sales growth, lower capital expenditures, and made fewer corporate acquisitions.

Flammer (2015)24 adopted a slightly different approach, by looking at the effect of shareholder proposals related to Corporate Social Responsibility (CSR) on financial performance. The study focused on CSR shareholder proposals that pass or fail by a small margin of votes. Using a regression approach, it found that the adoption of a close call CSR proposals leads to positive stock market returns on announcement.

- GunFinance & Investmentnar Friede, Timo Busch & Alexander Bassen (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies, Journal of Sustainable

- The study uses Asset4’s Board Diversity variable, which assigns a percentage diversity score to companies based on gender diversity and/or evidence of foreign board members. Companies are classified as ‘higher diversity’ if their Board Diversity score is greater than 20%, and ‘lower diversity’ if lower than 20%.

- From the stockholder to the stakeholder: How sustainability can drive financial outperformance, University of Oxford and Arabesque Partners, 2015

- Corporate Sustainability: First Evidence on Materiality, Mozaffar Khan, George Serafeim, and Aaron Yoon, HBS, 2015

- Matthew W. Sherwood & Julia L. Pollard (2018) The risk-adjusted return potential of integrating ESG strategies into emerging market equities, Journal of Sustainable Finance & Investment

- Kempf, Alexander; Osthoff, Peer (2007): The effect of socially responsible investing on portfolio performance, CFR Working Paper, No. 06-10, University of Cologne, Centre for Financial Research (CFR), Cologne

- Ge, W., Liu, M. Corporate social responsibility and the cost of corporate bonds. J.Account. Public Policy (2015), http://dx.doi.org/10.1016/j.jaccpubpol.2015.05.008

- I. Oikonomou, C. Brooks, and S. Pavelin. The effects of corporate social performance on the cost of corporate debt and credit ratings. The Financial Review, 49:49–75, 2014. doi: 10.1111/fire. 12025.

- Flammer, Caroline. “Corporate Green bonds.” Working Paper, 2018

- Caroline Flammer, (2019), Green Bonds: Effectiveness and Implications for Public Policy in NBER Chapters, National Bureau of Economic Research, Inc

- Engagement activities are not conducted directly by Rosenberg Equities. No representation is made as to the outcomes of engagement activities.

- Active Ownership, Elroy Dimson, Oğuzhan Karakaş, and Xi Li, 2012

- Local leads, backed by global scale: the drivers of successful engagement, Elroy Dimson, Oğuzhan Karakaş, and Xi Li, 2017

- How ESG engagement creates value: Bringing the corporate perspective to the fore, Jean-Pascal Gond, 2017

- ESG Shareholder Engagement and Downside Risk, Andreas Hoepner and al., University College Dublin (2018)

- R. Heinkel, A. Kraus, and J. Zechner. The effect of green investment on corporate behaviour. Journal of Financial and Quantitative Analysis, 2001

- S. Chava. Environmental externalities and cost of capital. Management Science, 2014

- ESG investing: a literature review, Søren Hvidkjær, 2017

- Shameek Konar and Mark A. Cohen. Does the Market Value Environmental Performance? The Review of Economics and Statistics, 2001

- R. Bauer and D. Hann. Corporate environmental management and credit risk. Working paper, 2014

- Does the stock market fully value intangibles? Employee satisfaction and equity prices, Alex Edmans Wharton School, 2011

- Edmans, Alex, Lucius Li, and Chendi Zhang. “Employee Satisfaction, Labor Market Flexibility, and Stock Returns Around The World.” European Corporate Governance Institute (ECGI) - Finance Working paper No. 433/2014. February 22, 2017.

- Does Diversity Provide a Profitability Moat? AXA IM Rosenberg Equities, 2018

- Corporate governance and equity prices, Paul A. Gompers, Harvard Business School, Quarterly Journal of Economics, 2003

- Caroline Flammer (2015) Does Corporate Social Responsibility Lead to Superior Financial Performance? A Regression Discontinuity Approach. Management Science

Not for Retail distribution

This document is intended exclusively for Professional, Institutional, Qualified or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document. Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.