What the rise of digital advertising means for investors

Key points

- Digital advertising now outstrips TV advertising as mobile spending booms

- Companies face an increasingly competitive landscape to reach consumers

- We see opportunities for companies to innovate in promoting their products

What long-term trend are we observing?

The COVID-19 pandemic means we are all a lot more reliant on the online world, with one study suggesting that online content consumption has more than doubled during the pandemic.1

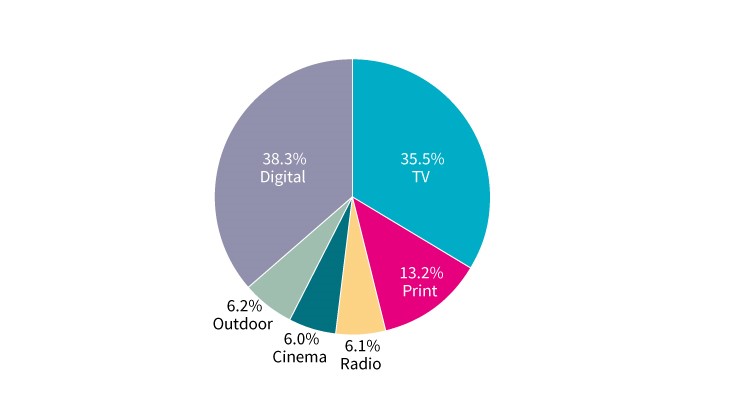

While the extent of the shift to online was significant last year, this is of course part of a wider trend. Global eyeballs have been moving online for some time now, with companies now spending more on digital advertising than traditional advertising. In 2018, we saw digital edge out TV as the leading destination for advertising spend globally.

Share of global advertising spend by media, 2018

Source: https://www.marketing-interactive.com/a-break-down-of-global-ad-spend-across-mediums/

Consumers are also increasingly shopping and purchasing on mobile, spending a record $10.8bn last Cyber Monday. 45% of consumers shop online via mobile devices now, compared to 30% before the pandemic.2 Mobile advertising will be increasingly important to ensure that companies are targeting customers in a way that reflects how they spend their day.

Overall, mobile advertising spending is expected to reach more than $240bn by 2022.3 Particularly interesting is the move away from TV, as advertisers see consumers moving from TV to on-demand services, many of which like Netflix are based on a paid-for subscription model rather than advertising. In the US, consumers are now more receptive to ads on social media than they are on television.4

What does this mean for investors?

Estimates vary, but the average consumer in a developed market can receive anywhere from around 2,500-5,000 advertising messages every day. Companies then face an enormous challenge in standing out in this highly crowded and competitive space for consumer awareness and engagement.

While choosing the right mix of advertising channels is essential, being able to develop creative and interesting advertising campaigns and content will be crucial for companies to develop meaningful interaction with their customers around products and services. Companies like Adobe, for example, aim to support businesses in this regard by providing them with both the market insight and creative tools they need to produce interesting digital content.

We therefore look closely at companies which help connect businesses promoting their products with the people searching for such goods and services. For example, platforms with large user bases like Facebook/Instagram or YouTube (owned by Alphabet, parent company of Google) have historically benefitted from the growth of advertising by offering tailored advertising solutions to businesses.

Follow the data

This seemingly irrevocable trend towards digital and mobile spending offers a rich universe of investment opportunities, as it impacts almost all companies whose products or clients are focussed on the end-consumer.

However, it is worth noting that while digital is one of the fastest-growing advertising segments, traditional advertising will by no means be relegated to history – companies will need to focus on the right blend of digital, mobile, outdoor, TV, print and other advertising as suits their business model, to ensure they connect with consumers consistently across multiple touchpoints.

Data in particular will play an increasingly important role – both for companies and advertisers to measure the effectiveness of advertising campaigns, but also to help make marketing more targeted and personalised.

The companies mentioned in this article are for illustrative purposes only and are not a recommendation to buy or sell individual securities.

- https://doubleverify.com/wp-content/uploads/2020/09/DV_Four_Fundamental_Shifts_In_Media_and_Advertising_During_2020.pdf

- Global Consumer Insights Survey 2020, PwC

- Statista, February 2021

- Statista, February 2021

Why consider investing in the technology sector?

At the heart of this evolution are innovative companies driving change across the entire economy – including how we work, shop, build relationships and find information.

Find out moreVisit the fund centre

The AXA Framlington Global Technology strategy is an unconstrained multi-cap strategy that seeks capital growth through investment in equities, with a focus on growth companies around the world focused on the research, design and development new technologies.

View fundsNot for Retail distribution

This document is intended exclusively for Professional, Institutional, Qualified or Wholesale Investors / Clients, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This promotional communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision.

Before making an investment, investors should read the relevant Prospectus and the Key Investor Information Document / scheme documents, which provide full product details including investment charges and risks. The information contained herein is not a substitute for those documents or for professional external advice.

The products or strategies discussed in this document may not be registered nor available in your jurisdiction. Please check the countries of registration with the asset manager, or on the web site https://www.axa-im.com/en/registration-map, where a fund registration map is available. In particular units of the funds may not be offered, sold or delivered to U.S. Persons within the meaning of Regulation S of the U.S. Securities Act of 1933. The tax treatment relating to the holding, acquisition or disposal of shares or units in the fund depends on each investor’s tax status or treatment and may be subject to change. Any potential investor is strongly encouraged to seek advice from its own tax advisors.

AXA Framlington Global Technology is a sub-fund of AXA World Funds. AXA WORLD FUNDS ‘s registered office is 49, avenue J.F Kennedy L-1885 Luxembourg. The Company is registered under the number B. 63.116 at the “Registre de Commerce et des Sociétés” The Company is a Luxembourg SICAV UCITS IV approved by the CSSF and managed by AXA Funds Management, a société anonyme organized under the laws of Luxembourg with the Luxembourg Register Number B 32 223RC, and whose registered office is located at 49, Avenue J.F. Kennedy L-1885 Luxembourg.

Past performance is not a guide to current or future performance, and any performance or return data displayed does not take into account commissions and costs incurred when issuing or redeeming units. References to league tables and awards are not an indicator of future performance or places in league tables or awards and should not be construed as an endorsement of any AXA IM company or their products or services. Please refer to the websites of the sponsors/issuers for information regarding the criteria on which the awards/ratings are based. The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested. Exchange-rate fluctuations may also affect the value of their investment. Due to this and the initial charge that is usually made, an investment is not usually suitable as a short term holding.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.