Why now may be an excellent entry point for US Short Duration High Yield

- 16 May 2022 (5 min read)

The recent sell-off in high yield has created an interesting buying opportunity for Short Duration High Yield.

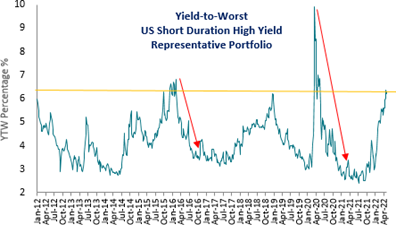

At 6.6%, US Short Duration High Yield’s current yield-to-worst is among the highest we’ve seen in over eleven years.

- Since 2011, there have been only two other (brief) periods where our US SDHY strategy had yields above 6.6%: Dec. 2015 - Feb, 2016 (energy crisis) and March - May 2020 (onset of the pandemic).

- As illustrated below, these sell-offs do not typically last long and tend to rebound very quickly.

Source: AXA IM US, FactSet. AXA IM US SDHY Representative portfolio exclusive of cash.

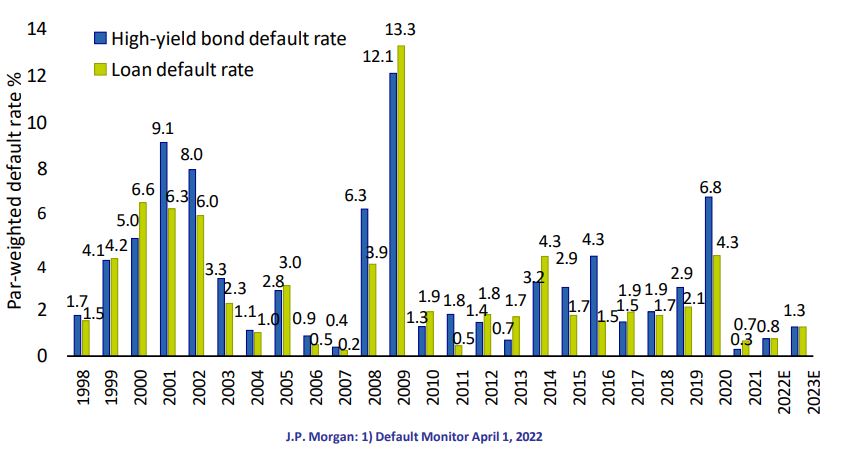

True default risk remains extremely low

- The current default rate is 0.21%, compared to the long-term average high yield default rate of 3.4%.

During a rising rate environment, Short Duration High Yield is constantly reinvesting into the new, higher yielding market.

- The natural turnover of SDHY results in a high generation of cash. This, along with our duration management aims to insulate and dampen volatility within a rising rate environment.

- Our US SDHY strategy generated positive total returns during years when short term interest rate rose in 2003-2006, 2009, 2013-2018, and 2021 (returns are Gross of fees).

History proves that US Short Duration High Yield has been resilient following market sell-offs

- Only 12 periods prior to 2022 when AXA IM’s US SDHY Strategy had two consecutive negative monthly returns

- In 10 out of the 12 periods, the 1M forward return was positive

- In all 12 periods, the 3M, 6M, and 12M forward returns were positive

No assurance can be given that our strategies will be successful. Investors can lose some or all of their capital invested. Our strategies are subject to risks including, but not limited to: Counterparty Risk, Liquidity Risk, Credit Risk.

High Yield Bonds

We offer a range of high yield strategies investing within and across regions, sectors and maturities.

find out moreVisit out fund centre

The aim of the strategy is to generate income by investing in high yield debt securities (being sub-investment grade corporate bonds) while seeking to avoid the risk of default.

View fundsRisk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.